How To Save Up In Between Jobs

As the part of the changing world, being between jobs is quite normal. Job-hopping has become a common affair and people don’t stick to one job like they used to. Millennials tend to move on to another job and live on their savings often, before getting another one. Even if you have got enough to last you for a couple of months, it is always wise to take it slow and save every penny you can. For honestly, the job market can be volatile at times and you can’t predict when a good offer might land up in your lap. So here are some honest tips on how to save up all you can when you are between jobs.

Share Your Home

This is the first and most important of all other expenses. It also takes up a big chunk of your savings. So how can you make the best of your situation? If you own a house, the cost of insurance and tax must be making a big dent in your savings. So, let out one of the rooms. You can use AirBnB if you do not have pressing needs. Otherwise, you can let it out for the long term too. Even when living out of your savings, try to take out a monthly amount from your savings, and keep the expenses within it. In case you are living in a rented place, ask around to say what are the rules for subletting a room. Some extra income will be really good during hard times. Alternatively, you can find a room-mate if you have a rented place.

Share Your Skill

If you have a skill, make the most of it. Teach it to others and make money. For some of them, you don’t even need to go out of your home. Which means you can save up on transport as well. You can very well do a teaching job from the comforts of your home. If it is not something substantial, put it to use by becoming tutors to individuals. You can become an English language trainer for those who have English as the second language. But you might need to have certain degrees for that.

Cut Down On Bills and Expenses

Cutting down on recurring bills and expenses will help you a lot. If you have a gym subscription, consider buying a few weights or using the free gym if there is any at your apartment. Often YMCA has great offers for families. If your family already has a membership, you can get in by just making a new card. When you go grocery shopping, always make a list of things to buy. That way you will be eliminating the unnecessary things that add up to your bill. Saving on cable bills have become easier than ever. Think of it, who watches Cable tv these days? When there are tons of great shows available on Netflix, Hulu, and the likes. Hulu comes for only $40 a month while Sling comes for $20 a month.

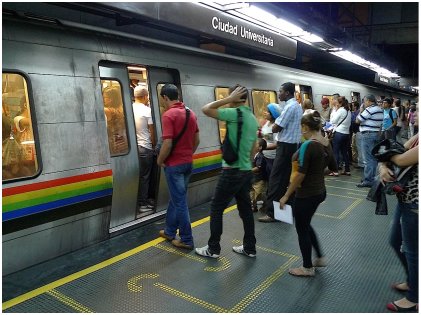

Save Up On Transport

If you live in a big city, you can do without the car. Try saving up on transport by making monthly passes for your bus, train or subway. Also, walk around. It will be a good exercise too and can compensate for your gym. In case you have a car and still want it around, shop for insurance. Often insurance companies will give you a cheaper deal based on your driving history. In case, you want to buy a car, because you can’t be without one, where you live, do an extensive research. Go for cars whose parts are a lot cheaper and at the same time durable as well. If there is an emergency where you need to change a part, at least it will not burn your pocket.

Most importantly, when you take out a limited amount every month from your savings, apply the 50-30-20 rule on it as well. Think of it as your salary and try to save 20% of it, keep 30% for variable costs and 50% for recurring monthly costs. Once you start saving up, it is almost like an addiction and you would want to save up each cent you can.

More in Business & Investments

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login