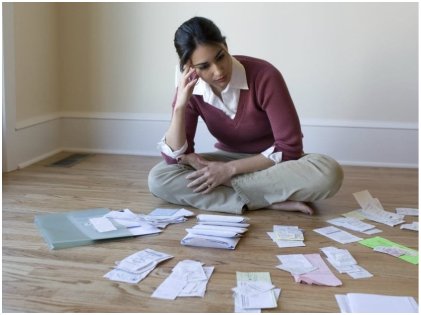

Best Financial Advise For Working Women

In today’s world, it is not right to differentiate a woman’s world from that of a man’s. Both share equal responsibilities in and out of a household. Even then, women are prone to become single parents, managing both the house and their jobs. Often, in this kind of situation, it is hard for them to allot extra time to do some personal budgeting. They are highly emotional beings, and often, this could lead to unwise decisions regarding finance. But it is extremely important for working mothers to have a solid financial plan that will help them during an emergency or when they retire. So ladies, listen up! Use these four tips to get a financially secure future:

Set A Monthly Budget

Based on your daily income, you need to have a fixed monthly budget. It is best to use the 50-30-20 rule, where you can set aside 50% of your income for recurring expenses you have every month like your house rent, taxes, energy bills, loan repayment, grocery bills, to name a few. 30% of your income should be left for variable expenses that include buying gifts, eating out, or going on a trip. The last 20% should be your savings. It is best to have a savings account in another bank which you can’t touch except for severe emergencies. This will help you save up for retirement, too.

Get Insurance

Women often care a lot for others, but forget to take care of themselves. Hence, they tend to suffer a lot. Accidents happen without any warning, so taking precaution is necessary. Aside from a health insurance, make sure your home and auto insurance are also updated. If it is all too much, look for cheaper options online. Often, based on your transaction or driving history, your insurances can get cheaper than what you are paying now. But do not compromise on add-ons like critical illness benefit or accidental death benefit. You will not only be providing for yourself but for your loved ones, too.

Don’t Just Save, Invest

It is not enough to save. Don’t get us wrong. The first step towards making your future secure is definitely saving. But once you have saved enough, you should and must invest your money. Keeping them in a bank account won’t grow your wealth. But if you invest them somewhere else, you will be generating more wealth. You can buy stocks, do trading, or invest in mutual funds. For those who are looking for safer options, you can buy real estate and put it on rent. An investment from where you can get a monthly income will take off a lot of load from your shoulders. That way, you can spend more time with your family or do what you love to do without the financial worries. So, with the 20% that you have been putting in your savings account, it is time to take it out and put it to some use. Make your money work for you.

Stop Impulsive Buying

Most women love shopping. For some, it is more than just buying stuff for the house or themselves. It is more like an escape to a world where they can forget their worries and indulge themselves. But sadly, this often results in impulse buying which they tend to regret later. If you know what we are talking about, you might be guilty of the same. However, since you have identified the problem already, half the work is done. Now, it is time to find out what you can do to stop it. If you love shopping online, why not add your stuff to the cart and stop yourself from buying it then and there. If after a day or two you check your cart, you might or might not find those things useful at all. Hence, the trick here is to delay the buying process.

Have Similar-Minded People In Your Circle

Spending time with friends who spend a lot might make you one of them. So if you are trying to save up, keep your circle limited to people who love a thrifty lifestyle and do not mind hanging out at home instead of going to an expensive restaurant every time. You can even exchange money-saving tips when you are together. They will have your back when you have a financial crisis and need help.

It might seem to be a daunting task for new mothers who have so many things in her mind, especially when the baby takes up the majority of their time. But don’t let it take a backseat and make finances your priority or else you might regret it.

More in Financial Advice

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login