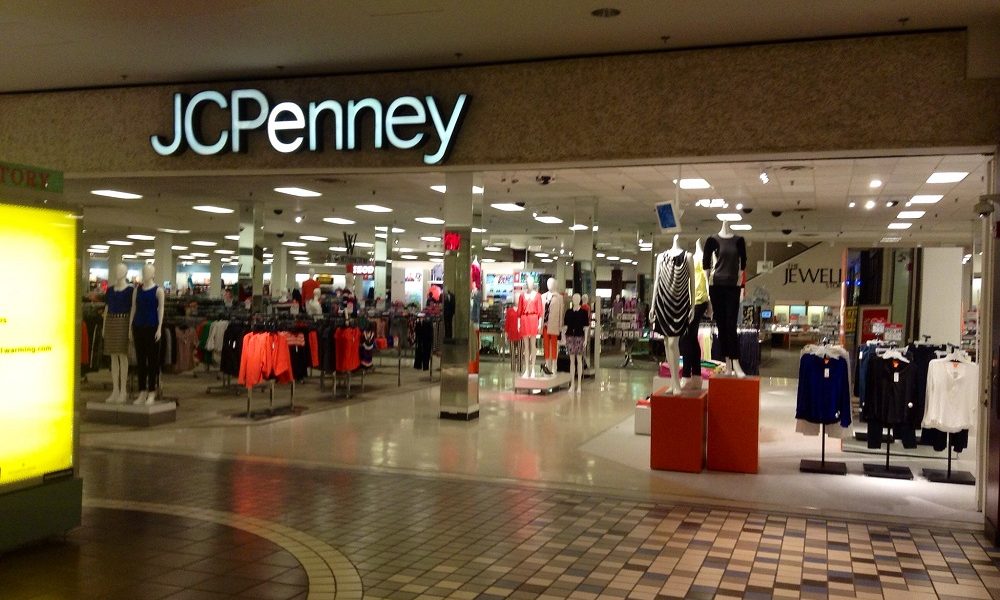

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This iconic retail giant, established over a century ago, has faced the challenges posed by the pandemic and a decade marked by poor decisions, executive instability, and shifting market trends.

In this article, we’ll delve into the rise and fall of JCPenney, the impact of COVID-19 on its fortunes, and what the future might hold for this once-thriving department store chain.

A Decade of Decline

JCPenney has been on a downward trajectory since 2016 when its sales began to tumble. The store footprint that once boasted around 860 locations has dwindled to less than a quarter of that, a stark contrast to the 2001 heyday. The company’s sales, which reached nearly $11 billion in the last fiscal year, have shrunk to almost a third of what they once were.

Once an employer for approximately 90,000 full- and part-time workers, JCPenney’s woes have also affected its workforce. These struggles culminated in the unfortunate decision to file for bankruptcy.

The Pandemic’s Final Blow

The COVID-19 pandemic acted as the final nail in the coffin for JCPenney. CEO Jill Soltau acknowledged the pandemic’s unprecedented challenges, emphasizing the need to protect employees and customers while securing the company’s future. She lamented that JCPenney was making significant progress in its Plan for Renewal strategy just before the outbreak. However, the pandemic’s abrupt closure of stores necessitated a comprehensive review that included debt elimination.

Despite the bleak circumstances, JCPenney secured commitments for $900 million in financing from existing first-lien lenders, with $450 million being fresh capital. Additionally, they had $500 million in cash at the time of the Chapter 11 filing.

A Leaner Future

Bankruptcy proceedings will see JCPenney reducing its store footprint in a phased approach. Details regarding specific store closures and timing will be revealed in the coming weeks, but preliminary reports suggest that up to 200 stores may face closure. Nonetheless, JCPenney intends to continue offering select in-store shopping and contact-free curbside pickup, ensuring it remains accessible to customers.

The retailer also plans to uphold its eCommerce distribution and customer care services. Furthermore, it seeks to redefine its strategy under CEO Soltau’s leadership, focusing on revitalizing the basics of retail, reimagining its product offerings, and introducing innovative solutions.

A Familiar Trend

JCPenney is not alone in its struggles; fellow department store chains like Neiman Marcus and Stage Stores have also fallen victim to the pandemic’s economic impact. These challenges have compounded existing issues for department stores in the ever-evolving landscape of U.S. retail.

Gustavo Fring/ Pexels | Based on the recorded statements, the market capitalization of J C Penney is about 58.56 M.

Many brands have bypassed department stores, opting to sell directly to consumers. Online retailers, in particular, have lured shoppers away from the mall-based locations that department stores often rely on. As the world changes, the old model of department store shopping seems to be fading into history.

A Glorious Past

JCPenney’s story began in 1913 when James Penney transformed a chain of 34 stores into the J.C. Penney company. The retailer quickly gained popularity by offering rural America a one-stop shop for essential goods at affordable prices.

By 1928, it boasted an impressive 1,000 stores, going public just a year before the onset of the Great Depression. In 1994, JCPenney’s retail sales hit a staggering $20.4 billion, with net income nearing $1 billion.

More in Business & Investments

-

`

Shifting Gears: Successfully Transitioning Your Client Base Across Industries

Ever feel that entrepreneurial itch to push your boundaries and explore new horizons? Perhaps you started with a laser focus on...

March 16, 2024 -

`

Music Icon Dolly Parton Reveals Secrets to Her $440 Million Fortune

Beloved country music legend Dolly Parton has long been an enigma wrapped in a rhinestone-studded enigma. At almost 80 years of age,...

March 9, 2024 -

`

Scaling Up Your Small Business: A Tightrope Walk With a Winning Plan

Building a thriving small business is like nurturing a seedling. You pour your heart and soul into its growth, watching it...

February 27, 2024 -

`

Is SZA All Set to Launch the Next Big Celebrity Makeup Line?

Today, celebrities launching their makeup lines have become as much of a trend as their next hit single. Among the glittering...

February 19, 2024 -

`

Healthy Lifestyle Habits for Ageless Aging

Be a Continuous Learner The pursuit of knowledge is the wind beneath the wings of our minds, keeping us aloft above...

February 16, 2024 -

`

Unlocking Financial Freedom: Your Roadmap to Building Business Credit

Embarking on the journey of entrepreneurship is exhilarating yet challenging. Among the myriad of tasks that come with starting and growing...

February 7, 2024 -

`

Envisioning the Future: The Shape of a Labour-Led UK Government

The wind whispers through the bustling pubs of Manchester, carrying murmurs of discontent. In the dimly lit corners, pints clink against...

January 31, 2024 -

`

What Are The Key Financial Dates to Keep an Eye on in 2024?

January 31: Deadline for Tax Returns Start the year on the right foot by ensuring your tax returns are filed by...

January 26, 2024 -

`

The Ultimate Rotisserie Chicken Showdown: A Battle of Flavors and Bargains

Prepare your taste buds for a flavor-packed journey as we dive into the delectable realm of rotisserie chickens. These savory wonders...

January 15, 2024

You must be logged in to post a comment Login