The Dangers of Relying on a Single Income Source

Living off a single income can present various challenges and disadvantages for individuals and families. While there are certain situations where this arrangement is a choice, such as when one partner stays at home to raise children, there are also cases where it results from financial constraints or unexpected circumstances. Today, we will explore the disadvantages of living off a single income source.

Financial Strain

One of the primary disadvantages of relying on a single income is the financial strain it can place on a household. With only one source of income, there is often less money available to cover expenses and save for the future. This can make it difficult to meet basic needs like housing, utilities, food, and healthcare. It may also limit the ability to enjoy certain luxuries or participate in activities that require additional financial resources.

Limited Career Opportunities

In households where one partner is solely responsible for earning income, the other partner may face limited career opportunities. This can occur when the individual has to prioritize caring for children or managing household responsibilities, leaving less time and energy for pursuing their career goals. As a result, they may experience slower career advancement, reduced earning potential, or difficulty reentering the workforce after an extended absence.

Increased Financial Vulnerability

Relying on a single income can make individuals and families more financially vulnerable. If the primary breadwinner loses their job or faces a financial setback, the household may struggle to maintain its standard of living. There is less room for financial flexibility or unexpected expenses, making it challenging to weather economic downturns or cope with emergencies. This vulnerability can lead to heightened stress and anxiety about financial stability.

Limited Saving and Retirement Planning

Living off a single income can make it harder to save for the future and plan for retirement. With fewer financial resources, saving for major expenses, such as a down payment on a house or funding a child’s education, can be challenging. Additionally, it may be difficult to contribute to retirement accounts at the desired level, potentially jeopardizing long-term financial security.

Unequal Distribution of Responsibilities

In households where one partner is solely responsible for earning income, responsibilities are often unequal. The burden of financial provision may rest heavily on one individual, while the other partner may take on more domestic duties or childcare responsibilities. This imbalance can lead to resentment or strain within the relationship and may impact overall household dynamics.

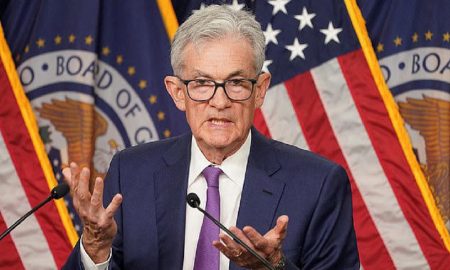

M&I FAMILY TEAM/ iStock | Financial struggles teach us resilience, resourcefulness, and the value of what truly matters

Limited Professional Development and Skill Maintenance

Individuals who rely on a single income often face limitations regarding professional development and skill maintenance. Investing in training, certifications, or continuing education opportunities may be challenging with fewer financial resources available. This can result in a stagnant career trajectory and potential skill gaps, making it more difficult to remain competitive in the job market.

More in Financial Advice

-

`

Shifting Gears: Successfully Transitioning Your Client Base Across Industries

Ever feel that entrepreneurial itch to push your boundaries and explore new horizons? Perhaps you started with a laser focus on...

March 16, 2024 -

`

Music Icon Dolly Parton Reveals Secrets to Her $440 Million Fortune

Beloved country music legend Dolly Parton has long been an enigma wrapped in a rhinestone-studded enigma. At almost 80 years of age,...

March 9, 2024 -

`

Scaling Up Your Small Business: A Tightrope Walk With a Winning Plan

Building a thriving small business is like nurturing a seedling. You pour your heart and soul into its growth, watching it...

February 27, 2024 -

`

Is SZA All Set to Launch the Next Big Celebrity Makeup Line?

Today, celebrities launching their makeup lines have become as much of a trend as their next hit single. Among the glittering...

February 19, 2024 -

`

Healthy Lifestyle Habits for Ageless Aging

Be a Continuous Learner The pursuit of knowledge is the wind beneath the wings of our minds, keeping us aloft above...

February 16, 2024 -

`

Unlocking Financial Freedom: Your Roadmap to Building Business Credit

Embarking on the journey of entrepreneurship is exhilarating yet challenging. Among the myriad of tasks that come with starting and growing...

February 7, 2024 -

`

Envisioning the Future: The Shape of a Labour-Led UK Government

The wind whispers through the bustling pubs of Manchester, carrying murmurs of discontent. In the dimly lit corners, pints clink against...

January 31, 2024 -

`

What Are The Key Financial Dates to Keep an Eye on in 2024?

January 31: Deadline for Tax Returns Start the year on the right foot by ensuring your tax returns are filed by...

January 26, 2024 -

`

The Ultimate Rotisserie Chicken Showdown: A Battle of Flavors and Bargains

Prepare your taste buds for a flavor-packed journey as we dive into the delectable realm of rotisserie chickens. These savory wonders...

January 15, 2024

You must be logged in to post a comment Login