The Most Famous Financial Advisors You Should Listen To

Some of the most historic names among financial advisors are those who never studied much about finances as a discipline, but took hazardous risks, and thereafter shared their knowledge with the masses. Often, there were successful investors, brokers, and others who led simple lives but had extraordinary dreams. They wrote books and educated people across several channels via broadcast and digital media – only to reach out to the world at large. Eventually, they became inspirational financial advisors without enrolling themselves in any formal course as such! And these gurus are who we look up to as we battle through tough decision-making. Here are a few of the best who you should look up to.

Benjamin Graham

When it comes to value investing, there’s no one more superior to the father – Benjamin Graham – himself. This investment occurs when undervalued stocks are identified and bought, which has all the potential to witness growth over time. To calculate the intrinsic value of a company, the approach is a solid one. After all, it eschews all such ideas, trends, and practices that rely a great deal on thorough research, financial analysis, and patience. No doubt these are what we considered as standards now, but back then it was truly revolutionary (at least in the 1930s). Some of the most successful investors in the last 70 years have been Graham’s disciples. For starters, The Intelligent Investor (1949) is a must-read, especially for stock traders and asset managers.

When it comes to value investing, there’s no one more superior to the father – Benjamin Graham – himself. This investment occurs when undervalued stocks are identified and bought, which has all the potential to witness growth over time. To calculate the intrinsic value of a company, the approach is a solid one. After all, it eschews all such ideas, trends, and practices that rely a great deal on thorough research, financial analysis, and patience. No doubt these are what we considered as standards now, but back then it was truly revolutionary (at least in the 1930s). Some of the most successful investors in the last 70 years have been Graham’s disciples. For starters, The Intelligent Investor (1949) is a must-read, especially for stock traders and asset managers.

Warren Buffett

Graham’s most famous follower is better known as the Oracle of Omaha. Investor Warren Buffett ensured he kept his mentor’s name alive, after adopting the principles taught to him. However, Buffett didn’t follow his guru blindly and he devised his strategies. He had offered huge profits to his original partners and that’s when he publicly announced the acquisition of the famous Berkshire Hathaway Inc. (BRK-A) in the late 1960s. The company was eventually made as to the holding company, for all the other investments he had.

Peter Lynch

In between 1977 to 1990, Lynch managed the Fidelity Magellan Fund (FMAGX). While acting in his tenure, he had provided investors with almost a 29% annual compounded rate of return. Once he left the fund, he took to authoring some of the best-sellers that we can lay our hands on even now! Three best-sellers detailed his investment philosophy and focused on small investors and their capability in performing better at the stock market, compared to the large asset managers.

In between 1977 to 1990, Lynch managed the Fidelity Magellan Fund (FMAGX). While acting in his tenure, he had provided investors with almost a 29% annual compounded rate of return. Once he left the fund, he took to authoring some of the best-sellers that we can lay our hands on even now! Three best-sellers detailed his investment philosophy and focused on small investors and their capability in performing better at the stock market, compared to the large asset managers.

Jim Cramer

We know him as the TV host, but originally he was the hedge fund manager. Best recognized for forming opinions on any stock or economic topic within the shortest time possible – he was a person with a rare quality indeed. The program Mad Money was the perfect blend of a fast and loud show. Even when chaos prevailed at large, Cramer dispensed practical advice and information targeted towards teaching individuals how they could think like true financial experts. His website TheStreet.com offers a sneak-peek into Wall Street-based news, views, commentaries, and more.

Robert Kiyosaki

With more than 30 million copies sold to date, the best-seller Rich Dad, Poor Dad is the brainchild of the genius author – Kiyosaki. The author also conducts frequent real estate seminars (franchised via the Rich Dad Company) and personal finance sessions. He stands out for his fundamental philosophy – the creation of passive streams of investment income and continued growth of the same, till those can offer adequate support and you don’t have to work.

With more than 30 million copies sold to date, the best-seller Rich Dad, Poor Dad is the brainchild of the genius author – Kiyosaki. The author also conducts frequent real estate seminars (franchised via the Rich Dad Company) and personal finance sessions. He stands out for his fundamental philosophy – the creation of passive streams of investment income and continued growth of the same, till those can offer adequate support and you don’t have to work.

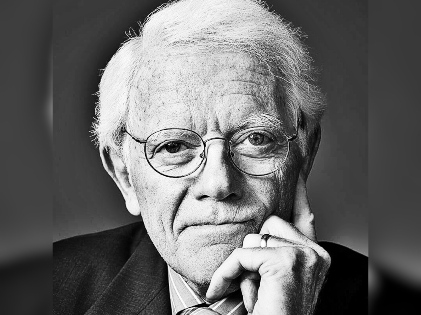

Ben Stein

If you have watched Comedy Central’s prime show Win Ben Stein’s Money, then you would know the fame and name that the actor and host has carved for himself. But did you know that he’s also a former economist and a law professor? Certainly, his Hollywood persona made him a larger-than-life figure, and he is a much sought-after guest in several shows now, mostly based on financial news. With his amazing and confident personality, along with wit, humor, expert advice, and straightforward opinions – he sticks to the point, no matter what.

If you choose to take their words and thoughts into account and walk in their footsteps, the likelihood of you making it to this list sooner and later can’t be ruled out either. At least, you will attain financial freedom, something you yearned for.

More in Financial Advice

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login