This Flexible Budget Method Could Save Your Finances

Financial planning is crucial. We are continually looking for ways to make money, save it, and spend it. That’s not just how our money financial health is in good shape, but the economy is also. Are you looking for a spending plan? There are many models to choose from, but, we will dive into the 50/20/30 method of budgeting. This is a budget system that makes monthly budgeting more flexible, and it is rather sustainable as it focusing on spending on broad categories. If you hate budgeting for individual expenses every month, this is the budgeting method for you!

Financial planning is crucial. We are continually looking for ways to make money, save it, and spend it. That’s not just how our money financial health is in good shape, but the economy is also. Are you looking for a spending plan? There are many models to choose from, but, we will dive into the 50/20/30 method of budgeting. This is a budget system that makes monthly budgeting more flexible, and it is rather sustainable as it focusing on spending on broad categories. If you hate budgeting for individual expenses every month, this is the budgeting method for you!

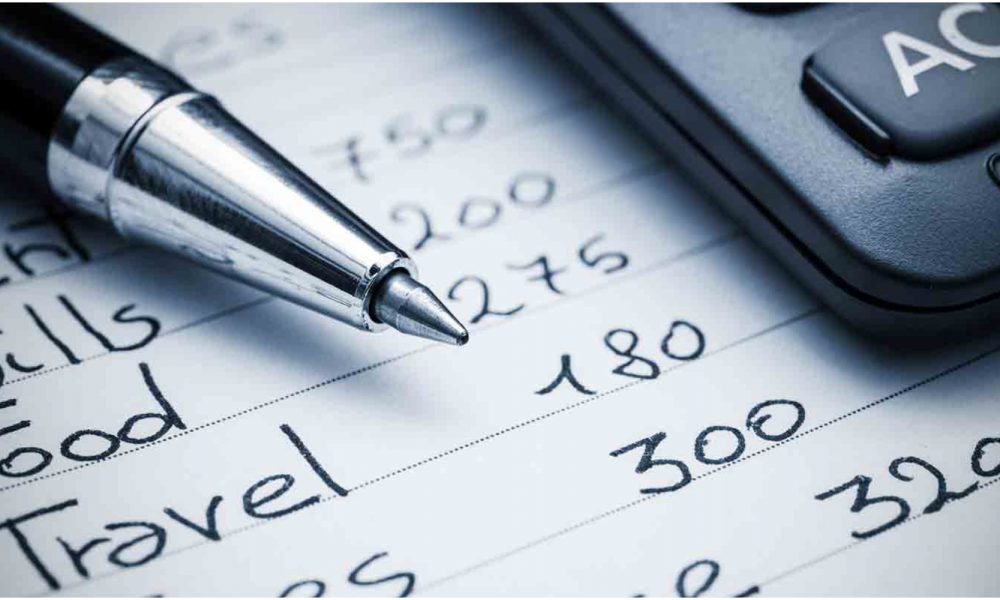

How the 50/20/30 method Works

50% to Needs

With this method, the idea is that no more than half of your monthly income should go on necessities. Your needs include the bills that are necessary to pay to meet your financial obligations and your basic needs. Under this bracket will fall your rent or bond, utility bills, groceries, and transportation costs, and heating expenses. Personal insurances and asset insurances also form a part of this category. Also included here is your medical aid or hospital plan premium. Everything that you need to pay for to live your life goes from this bracket.

20% to Savings and Debts

20% of your monthly income is for payment of a debt, reducing your debt bills, and savings. This means payments for credit cards or personal loans, the building of an emergency fund, or even a tax-free savings account, investments or policies, or your retirement savings. So this category is one for financial goals and freeing of debt, should you have accumulated any.

20% of your monthly income is for payment of a debt, reducing your debt bills, and savings. This means payments for credit cards or personal loans, the building of an emergency fund, or even a tax-free savings account, investments or policies, or your retirement savings. So this category is one for financial goals and freeing of debt, should you have accumulated any.

30% to Wants

The last 30% of your income goes to the most exciting category – your wants! This is a category where you use funds to pay for entertainment, eating out, gym memberships, clothing shopping, and whatever else tickles your fancy. Whatever you want to end money on that isn’t a necessity, or debt will typically come out of this category. Make sure that if you are buying luxury grocery items like expensive cuts of meat, alcohol, chocolates, and desserts and the like, that these fall under the wants category and not into the needs! While these items are groceries, they aren’t needs! If you do cheat, you are only cheating yourself.

Customize the Method

The beauty of the 50/20/30 budgeting method is that it is also very easy to adapt to your own needs and circumstances. For example, if you are a high earner, you may not require 50% of your income to go to basic expenses and necessities. Or perhaps you have more debt to pay, in which case you will need to spend less than 30% of your budget on wants and more than 20% on debt repayment and savings. Maybe you just aren’t the type of person to spend a lot on leisure, which leaves you with more money to spend on savings!

How To Calculate Your Spending

This budgeting method uses simple math for the calculation of the actual amounts in money that you have to spend on each of the three categories every month. Use your net income, which is your income after tax, to calculate the three categories. If you are someone who receives variable pay, simply use an average over the year or as many months as possible to form your base salary.

This budgeting method uses simple math for the calculation of the actual amounts in money that you have to spend on each of the three categories every month. Use your net income, which is your income after tax, to calculate the three categories. If you are someone who receives variable pay, simply use an average over the year or as many months as possible to form your base salary.

Then, simply divide your income into the three categories by multiplying the base value by 0.50, 0.20, and 0.30. If you have adjusted the 50/20/30 ratio to fit your needs, you have to adjust these figures as well. But it is so simple that there can be no excuses not to do it! And soon, you will notice your savings increasing considerably.

So many people live with their spending priorities totally out of balance. It’s important to take the necessary steps to adjust them by understanding budgeting methods and how they work. The 50/20/30 method is one you can easily use to make your budgeting easy, efficient, and fast! Don’t delay – budget today! And the future you, is sure to thank you for taking action in the right direction and working on a budget. You could also take the help of a financial consultant to get the numbers and planning right! That way your future will be safe and secure financially.

More in Financial Advice

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login