To Spend Or To Save: That Is The Question!

While growing up, we are all taught about frugality. It became a way of life for many to spend as little as possible and to pump everything else into a savings account. This can easily make you develop a mindset that makes you hate spending your money. Is that a bad thing?

We’ve All Been There

Think of the things you have always dreamed of doing. Wouldn’t you want to enjoy some of the things before your retirement when you are still young enough to fully experience things like travel, adventurous thrills, hikes, or snorkeling? Life is fragile, and you ever know where you will be or what condition you will experience in the distant future.

This is a tricky point in terms of finances for most people. The pundits insist on scrimping, saving, and sacrificing everything for the future, but you have to consider that life passes by very quickly. Surveys show that people are not enjoying their money enough. Affluent Americans were asked what they regretted financially, and 15% responded by saying they wished they had enjoyed their money more.

Change Your Mindset

It’s time you change your mindset about the way you spend and the way you save. After all, you are working for your money and you can do whatever you wish to do with it, so there is no reason to feel selfish about it! There will naturally be nervousness about outliving your savings, but you have to properly plan for your future while striking a balance such that you enjoy your present — there is no time like the present!

This financial advice needs to be clarified though – it is certainly financially detrimental to spend all of your money and have no savings or to spend all your savings to tick off activities on your bucket list. Enjoying your money takes the shape of keeping aside a fraction of your income specifically for spending. Choose wisely on how you spend it, and it is best to spend it on experiences.

Think Outside The Box

Think about this – so many people value the principle of leaving behind an inheritance for their loved ones, but they end up sacrificing a whole life worth living to do so. When their loved ones are enjoying their wealth, they are already six feet under! You don’t really want to be in that boat, do you? Change the way you think about inheritance – maybe instead of leaving monetary wealth, consider leaving your loved ones a wealth of memories of you. Live your life by spending money to enjoy life with the ones you love and create a life you enjoy living while leaving behind memories for them to cherish.

Think about this – so many people value the principle of leaving behind an inheritance for their loved ones, but they end up sacrificing a whole life worth living to do so. When their loved ones are enjoying their wealth, they are already six feet under! You don’t really want to be in that boat, do you? Change the way you think about inheritance – maybe instead of leaving monetary wealth, consider leaving your loved ones a wealth of memories of you. Live your life by spending money to enjoy life with the ones you love and create a life you enjoy living while leaving behind memories for them to cherish.

It really is a shame for you to have to live life thinking that you have to spend the best, healthiest years of your life working your hardest just so that you can afford basic survival in the difficult, worst years of your life. It sure is time for people to rethink finances and to begin valuing the importance of enjoying life as well as saving for the future. Without this balance, you may end up bitter about the choices you have made. If you know of any old or retired people who can share their honest feelings with you, perhaps they may help you change your mind about how you spend and save – if we haven’t already, of course!

Choose Your Adventures

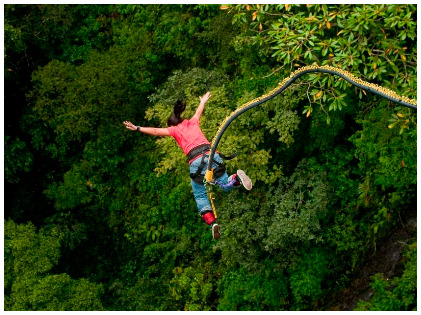

It is time to think about what makes you happy. If making others leads to that, then spend on performing charitable acts for the community or otherwise. Using some of your money to make others happy can be very fulfilling. If what makes you happy is spending time with your loved ones, then save for a cruise, a safari trip, or some other experience with those you love. Take a camera and enjoy spending money on memories. If it makes you happy to have thrilling experiences, go on that bungee jump, free fall, or abseiling adventure. You won’t be able to do it when you’re 70!

It is time to think about what makes you happy. If making others leads to that, then spend on performing charitable acts for the community or otherwise. Using some of your money to make others happy can be very fulfilling. If what makes you happy is spending time with your loved ones, then save for a cruise, a safari trip, or some other experience with those you love. Take a camera and enjoy spending money on memories. If it makes you happy to have thrilling experiences, go on that bungee jump, free fall, or abseiling adventure. You won’t be able to do it when you’re 70!

But saving is still important – so don’t use enjoyment and the creation of memories as an excuse to cut your retirement contributions short. Life is for the living – grab hold of your finances and take control of your life. Live now — and live later, too!

More in Financial Advice

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login