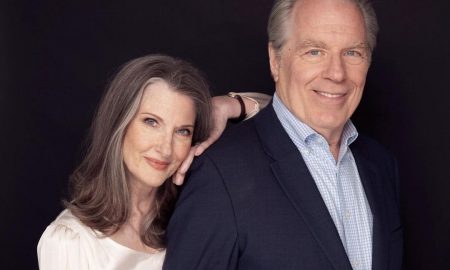

Here’s How You Can Work As a Team With Your Spouse To Save Money

As husband and wife, you can make a great team and sort out several household issues quite effectively. Financial matters are one of the most serious issues that you need to take up with your spouse. If you and your partner want to cut down your expenses and save money, you guys need to coordinate to get the best results.

As husband and wife, you can make a great team and sort out several household issues quite effectively. Financial matters are one of the most serious issues that you need to take up with your spouse. If you and your partner want to cut down your expenses and save money, you guys need to coordinate to get the best results.

Every family has a financial goal, and for that, you will need enough money. Moreover, saving cash for old age is necessary. Below are some effective tips that will help you set aside cash on almost everything, ranging from day-to-day expenses to going out for dinner and saving money for the future.

Have A Healthy Competition

Saving money as a couple isn’t tough. It’s fun. You guys can have a competition with each other to see who can save the most in a month. The one who loses will have to pay for the dinner when the month ends.

The best way to calculate this is to determine the percentage of money saved on the amount of money earned. This helps as the monthly income of you, and your spouse might not be equal. Such a competition would bring out the best in you two, and you will be eager to come up with new and innovative ways to save more funds.

Set Common Financial Goals

In case you and your spouse don’t have anything in common in terms of financial goals, saving money might get more challenging for both of you. This is why you need to sit and discuss whatever goals you have and then decide how and where you will be directing your funds. It will be easier for you to skip a meal when you both are aware that the money will go to the right place.

In case you and your spouse don’t have anything in common in terms of financial goals, saving money might get more challenging for both of you. This is why you need to sit and discuss whatever goals you have and then decide how and where you will be directing your funds. It will be easier for you to skip a meal when you both are aware that the money will go to the right place.

Chalk Out A Budget

Saving money will be an uphill task if you don’t know where you are spending your hard-earned money. Therefore, both spouses should keep track of their expenses for two to three months by jotting down every purchase they make.

Saving money will be an uphill task if you don’t know where you are spending your hard-earned money. Therefore, both spouses should keep track of their expenses for two to three months by jotting down every purchase they make.

After you take note of your spending graph, you can make the necessary adjustments and accentuate your savings. It’s not budgeting, but rather coming up with a spending plan where saving becomes a priority.

Use A Budgeting App

If you are not aware of where all your money is going, sticking to a budget plan becomes difficult. The good news is that things become a lot more convenient with the use of budgeting apps.

Choose a budget-tracking app that you two can sync between your phones. When you share the information between yourselves, you and your partner will be accountable for every penny you guys spend. Knowing that your partner will find out about your next purchase, you will automatically cut down your spending. This way, you will also refrain from breaking the monthly budget.

Never Hide Your Expenses

According to a survey, 20% of Americans have spent $500 or even more without their spouse’s knowledge. This is a kind of financial infidelity that can prove detrimental to a couple’s financial goals. Partners should never hide any spending from their partners and, thus, keep things in check.

According to a survey, 20% of Americans have spent $500 or even more without their spouse’s knowledge. This is a kind of financial infidelity that can prove detrimental to a couple’s financial goals. Partners should never hide any spending from their partners and, thus, keep things in check.

Of course, you cannot avoid purchasing gifts for each other on occasions. But, when you realize that every penny you shell out has to have your partner’s approval, you probably won’t make any unplanned expenses.

Make A Living Off One’s Earnings And Save The Other’s

Buying things you need or want becomes a lot easier when both you and your partner work. When you live off one’s earnings and save the other’s, you get a great opportunity to attain your financial objectives and build up some nice savings for the days ahead.

Put the income you have decided not to touch in a different account so that you don’t even consider it while chalking out the monthly budget.

You can also have a joint bank account, make tax breaks work to your advantage, make use of the gift cards that allow you to buy gifts at a discounted price, work out at home and save your gym costs, watch less television as much as possible, etc. And soon, you will notice how your finances will fall into place!

More in Business & Investments

-

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023 -

`

Transform Your Retail Business With Social Media Mastery

If you’re a retail marketer posting your social media messages haphazardly, you might be missing out on prime opportunities to turn...

September 26, 2023

You must be logged in to post a comment Login