Banish Your Overspending Habits With These Simple Tips!

When it comes to shopping, most of us are guilty of overspending. We just had to avail that “buy-one-get-one” promo. The pricey dress was simply too cute to leave behind! And so, we splurge and spend, and once we’re home, we look at our purchases and feel guilt settle in the pit of our stomachs — hundreds of dollars down the drain when it could have been set aside for a rainy day! Then, the vicious cycle starts once more the following month, and despite your intentions of spending less and saving up, it’s just too hard to pass off the chance to buy a great bargain at the mall sometimes. However, you need to keep your finances under control and stick to a budget that prevents you from splurging money. How do you do it? Continue reading!

Realize Your Triggers

Impulsive shopping is one of the major reasons why we overspend. When you are out on your shopping spree, it’s hard not to notice your favorite stuff neatly arranged on the snacks aisle. You intend to buy two t-shirts for yourself, but two more catch your fancy, and you end up buying them, thus blowing the budget that you had wanted to follow. These are examples of trigger moments that you need to have a control on. It’s important to do that if you are serious about your finances. Try to figure out some more constructive ways to satiate yourself. It can be anything. Just scroll through your smartphone or keep yourself busy on something else. Once you get to know why you actually overspend, you are bound to come across some practical solutions to curb your overspending habit.

Impulsive shopping is one of the major reasons why we overspend. When you are out on your shopping spree, it’s hard not to notice your favorite stuff neatly arranged on the snacks aisle. You intend to buy two t-shirts for yourself, but two more catch your fancy, and you end up buying them, thus blowing the budget that you had wanted to follow. These are examples of trigger moments that you need to have a control on. It’s important to do that if you are serious about your finances. Try to figure out some more constructive ways to satiate yourself. It can be anything. Just scroll through your smartphone or keep yourself busy on something else. Once you get to know why you actually overspend, you are bound to come across some practical solutions to curb your overspending habit.

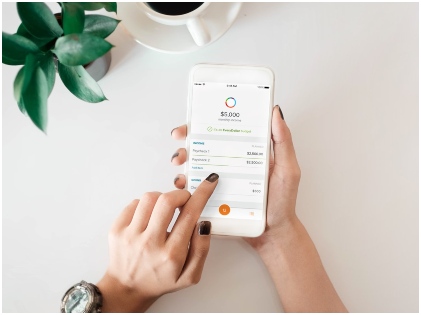

Keep a Track of Your Budget

The smartest way to stop yourself from splurging is to prepare a budget and keep an account of where and how much you are spending. A rough idea about this won’t help. You have to have a clear knowledge regarding all your expenses. Make a list of all the things that you need to spend every month — this can include utility bills, groceries, and debt payments. After that, write down every other things that you’ve spent on, that being the amount you spent on your wants. As the month nears its completion, sit down and carry out a thorough analysis of your spending habits. The outcome might be quite surprising for you. Gradually, you will realize that you can easily cut out all the irrelevant expenses from your budget without having to sacrifice much. Now, isn’t that lovely?

The smartest way to stop yourself from splurging is to prepare a budget and keep an account of where and how much you are spending. A rough idea about this won’t help. You have to have a clear knowledge regarding all your expenses. Make a list of all the things that you need to spend every month — this can include utility bills, groceries, and debt payments. After that, write down every other things that you’ve spent on, that being the amount you spent on your wants. As the month nears its completion, sit down and carry out a thorough analysis of your spending habits. The outcome might be quite surprising for you. Gradually, you will realize that you can easily cut out all the irrelevant expenses from your budget without having to sacrifice much. Now, isn’t that lovely?

You Need To Prioritize

Many a time, you might have noticed that overspending happens because of various societal pressures. Sometimes, it becomes pretty hard for you to say “no”. Maybe your friends are constantly after you for a treat or maybe your spouse is always telling you about going on a vacation. Your kids can even come into the picture, asking for gifts to show off to their friends in school. So, what do you do? Think about all those things you have prioritized. You can’t splurge money on unnecessary things when you know you would have to pay your interests on home loan this month, right? Learn to say NO. Focus on issues which are more important and don’t just give in to incessant pressures from friends, family, or even yourself. The sooner you do it, the more financially independent you will be.

Many a time, you might have noticed that overspending happens because of various societal pressures. Sometimes, it becomes pretty hard for you to say “no”. Maybe your friends are constantly after you for a treat or maybe your spouse is always telling you about going on a vacation. Your kids can even come into the picture, asking for gifts to show off to their friends in school. So, what do you do? Think about all those things you have prioritized. You can’t splurge money on unnecessary things when you know you would have to pay your interests on home loan this month, right? Learn to say NO. Focus on issues which are more important and don’t just give in to incessant pressures from friends, family, or even yourself. The sooner you do it, the more financially independent you will be.

Stick To Your Budget

Never ever spend more than you can afford. If you have the habit of spending every last cent after receiving every single paycheck that comes your way, you are in for some critical times ahead. You never know what’s waiting for you in the future — whether it’s a financial crisis because of debts or a medical emergency, it’s always wise to have a couple of hundred bucks on the side. If you keep on splurging money at the drop of a hat, will you ever be able to counter and resolve unforeseen situations? On top of that, if you fall into debt while overspending, nothing can be more unfortunate. If you owe money, pay that out first, along with the interest. Think about spending money on other things later. You have to learn sticking to your capacity. Certainly, that won’t be easy at the start. But a little try from time to time will earn you success for sure.

Never ever spend more than you can afford. If you have the habit of spending every last cent after receiving every single paycheck that comes your way, you are in for some critical times ahead. You never know what’s waiting for you in the future — whether it’s a financial crisis because of debts or a medical emergency, it’s always wise to have a couple of hundred bucks on the side. If you keep on splurging money at the drop of a hat, will you ever be able to counter and resolve unforeseen situations? On top of that, if you fall into debt while overspending, nothing can be more unfortunate. If you owe money, pay that out first, along with the interest. Think about spending money on other things later. You have to learn sticking to your capacity. Certainly, that won’t be easy at the start. But a little try from time to time will earn you success for sure.

These are some smart steps on how you can stop yourself from overindulging in unnecessary expenses and save money for yourself or your family’s future. You should start incorporating these into your life now!

More in Business & Investments

-

`

FTX Estate Sues Investment Firm for $700 Million

In a legal battle that has caught the attention of the crypto world, the bankrupt estate of crypto exchange FTX has...

December 4, 2023 -

`

The Sky’s the Limit: Qantas Aims for Ultra-Long-Haul Records

Long-haul flights are making a grand return, signaling the optimism among airlines that international travel is on the rebound post the...

December 2, 2023 -

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023

You must be logged in to post a comment Login