Top Five Apps For Your Investment Needs!

Investing online has become simple nowadays — all you need is an investment app. Last year, the number of apps downloaded counted up to a staggering 149.3 billion, and this number is all set to accentuate to 197 billion by the end of 2018 before zooming higher up to 352.9 billion by the year 2020. The latest study reveals that savvy investors in the US access at least nine apps on a daily basis and 30 in a month. If you want to be a savvy investor, here are a few investment apps that have gained wide currency among investors of today. But before you choose any of these available apps on the marketplace, you must go through the minute details since there are high chances that such costs may include commissions of brokers and advisors, too. The following apps are available on both iTunes and Google Play and are completely free to download.

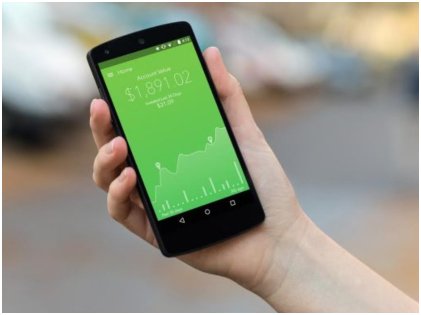

Acorns

The Acorns app can be linked to your debit as well as credit cards, and it also functions with PayPal. This makes your savings simplified by rounding up the total cost you incurred while making a purchase to the nearest dollar and putting the change on investments. This app offers you simple investment tips and along with that, incentives by predicting the real picture of your exact financial situation after 30 years, considering your continuous investing approach. Although Acorns work best with taxable accounts at the present moment, it also works with traditional accounts and retirement accounts, too. The only disadvantage is that there is no tax-harvesting feature present in this app.

The Acorns app can be linked to your debit as well as credit cards, and it also functions with PayPal. This makes your savings simplified by rounding up the total cost you incurred while making a purchase to the nearest dollar and putting the change on investments. This app offers you simple investment tips and along with that, incentives by predicting the real picture of your exact financial situation after 30 years, considering your continuous investing approach. Although Acorns work best with taxable accounts at the present moment, it also works with traditional accounts and retirement accounts, too. The only disadvantage is that there is no tax-harvesting feature present in this app.

Robinhood

Robinhood proffers trading free-of-cost for self-directed cash or margin brokerage accounts. Before you dive in, go through all the associated costs that are listed which may include a fee of $50 every time you trade in securities that are foreign-listed or a broker-assisted trade fee of $10. By incorporating a stock on your watch list, you will receive notifications about ebbs and flows of the share price. Over-the-counter stocks are not available in Robinhood and that makes trading cumbersome.

Robinhood proffers trading free-of-cost for self-directed cash or margin brokerage accounts. Before you dive in, go through all the associated costs that are listed which may include a fee of $50 every time you trade in securities that are foreign-listed or a broker-assisted trade fee of $10. By incorporating a stock on your watch list, you will receive notifications about ebbs and flows of the share price. Over-the-counter stocks are not available in Robinhood and that makes trading cumbersome.

Swell Investing

This app has all the support from Pacific Life Insurance Co., and this particular investing platform contains innovative themes that are based on clean water, renewable energy, zero waste, green technologies, disease eradication, and healthy living – all of which are sustainable environmental protection objectives of the United Nations. Portfolio assets are reviewed and rebalanced every quarter to make sure that assets are in complete alignment with the goals of the UN. Swell Investing’s major advantage is that it functions with taxable accounts or a retirement account where you would get options for SEP IRA, Roth, or a traditional account as well. Expense ratios are not available since Swell allows investing in stocks only, not ETFs.

This app has all the support from Pacific Life Insurance Co., and this particular investing platform contains innovative themes that are based on clean water, renewable energy, zero waste, green technologies, disease eradication, and healthy living – all of which are sustainable environmental protection objectives of the United Nations. Portfolio assets are reviewed and rebalanced every quarter to make sure that assets are in complete alignment with the goals of the UN. Swell Investing’s major advantage is that it functions with taxable accounts or a retirement account where you would get options for SEP IRA, Roth, or a traditional account as well. Expense ratios are not available since Swell allows investing in stocks only, not ETFs.

Stash

Stash offers you over 30 investment options that investors generally choose based on preference and risk tolerance. Unconventional nomenclature of investment options is one feature that makes this app unique. The app plays an important role in helping users to invest automatically and to keep all their transactions cheaper at the same time. You need to shell out an account fee of $1 every month if you have a balance of less than $5000 and 0.25 every year if your balance is $5000 or above.

Stash offers you over 30 investment options that investors generally choose based on preference and risk tolerance. Unconventional nomenclature of investment options is one feature that makes this app unique. The app plays an important role in helping users to invest automatically and to keep all their transactions cheaper at the same time. You need to shell out an account fee of $1 every month if you have a balance of less than $5000 and 0.25 every year if your balance is $5000 or above.

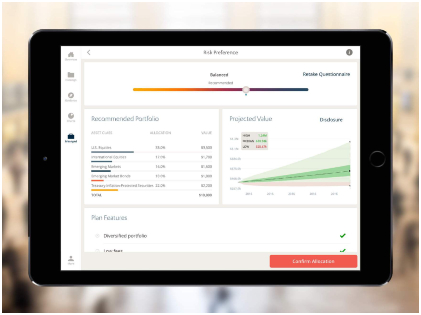

SigFig

This app functions as a middleman and connects investors to third-party brokerage accounts, as well as SigFig advisors. It offers investment advice, along with two additional services such as a managed account and a portfolio tracker that come entirely free of cost. You can avail these two services on the live chat, too. The managed account comprises reinvesting, automatic rebalancing, access to a professional financial advisor, and tax-loss harvesting. The yearly fee includes trading costs, but tax-loss harvesting may incur a trade fee that’s separate from the brokerage. Other apps will provide a longer and a detailed history of individual brokerage accounts, but SigFig offers an overview that encompasses three years of trading history.

This app functions as a middleman and connects investors to third-party brokerage accounts, as well as SigFig advisors. It offers investment advice, along with two additional services such as a managed account and a portfolio tracker that come entirely free of cost. You can avail these two services on the live chat, too. The managed account comprises reinvesting, automatic rebalancing, access to a professional financial advisor, and tax-loss harvesting. The yearly fee includes trading costs, but tax-loss harvesting may incur a trade fee that’s separate from the brokerage. Other apps will provide a longer and a detailed history of individual brokerage accounts, but SigFig offers an overview that encompasses three years of trading history.

These apps can be really helpful if you want to get access to the high-priced shares, and these can actually make investing a lot easier than you ever thought. But before taking a step forward, you must go through the finer details of such apps to avoid paying commissions to brokers and advisors and to see which one suits you the most.

More in Business & Investments

-

`

Shifting Gears: Successfully Transitioning Your Client Base Across Industries

Ever feel that entrepreneurial itch to push your boundaries and explore new horizons? Perhaps you started with a laser focus on...

March 16, 2024 -

`

Music Icon Dolly Parton Reveals Secrets to Her $440 Million Fortune

Beloved country music legend Dolly Parton has long been an enigma wrapped in a rhinestone-studded enigma. At almost 80 years of age,...

March 9, 2024 -

`

Scaling Up Your Small Business: A Tightrope Walk With a Winning Plan

Building a thriving small business is like nurturing a seedling. You pour your heart and soul into its growth, watching it...

February 27, 2024 -

`

Is SZA All Set to Launch the Next Big Celebrity Makeup Line?

Today, celebrities launching their makeup lines have become as much of a trend as their next hit single. Among the glittering...

February 19, 2024 -

`

Healthy Lifestyle Habits for Ageless Aging

Be a Continuous Learner The pursuit of knowledge is the wind beneath the wings of our minds, keeping us aloft above...

February 16, 2024 -

`

Unlocking Financial Freedom: Your Roadmap to Building Business Credit

Embarking on the journey of entrepreneurship is exhilarating yet challenging. Among the myriad of tasks that come with starting and growing...

February 7, 2024 -

`

Envisioning the Future: The Shape of a Labour-Led UK Government

The wind whispers through the bustling pubs of Manchester, carrying murmurs of discontent. In the dimly lit corners, pints clink against...

January 31, 2024 -

`

What Are The Key Financial Dates to Keep an Eye on in 2024?

January 31: Deadline for Tax Returns Start the year on the right foot by ensuring your tax returns are filed by...

January 26, 2024 -

`

The Ultimate Rotisserie Chicken Showdown: A Battle of Flavors and Bargains

Prepare your taste buds for a flavor-packed journey as we dive into the delectable realm of rotisserie chickens. These savory wonders...

January 15, 2024

You must be logged in to post a comment Login