Did You Know That These Six Factors Affect Your Car Insurance?

If you have bought a new car, then chances are that you are looking for the best insurance rates in the market. While you do that, bear in mind that there are actually a few things that affect your car insurance. Sometimes, the premium is so high that you are almost tempted to go for a rate that doesn’t have full coverage or even choose to raise your deductibles. However, you only realize your mistake after an accident. So, what can you do to lower your car insurance rate? Know about these factors that affect your car insurance premium:

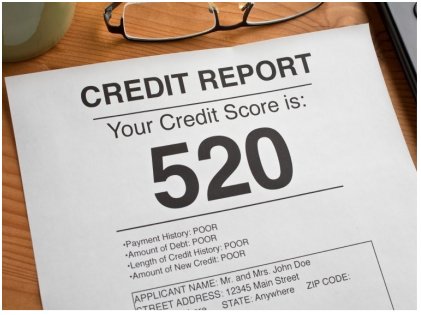

Bad Credit Score

This is one of the most important factors that insurance companies keep in mind while calculating your premium. A bad credit or a low credit score will definitely mean a higher premium. Add to it your age and gender. Males under the age of 25 who have bad credit scores are in for a nasty surprise in terms of higher premiums. There has been a difference of almost 100 percent between the premium of someone with poor credit score and someone with good credit score. Even someone who has a flawless driving record might end up paying huge premiums just because of their poor credit score.

Your Car Make And Model

Your car make and model also influences your car insurance premium. It doesn’t take much to understand that an upscale sports car will have higher insurance rates than other cars. Other aspects that are likely to influence your insurance rate is the age and size of the car, shady history, and even the safety rating of your car. Another thing that might affect your insurance premium is how much horsepower your car engine has. The more the horsepower, the faster your car can run, which puts you at a greater risk of being in an accident. Before buying a car, it is best to consult and discuss with your insurance provider what your premium would be. Sometimes, even if you are buying a very common car that you feel is practical, you might end up paying a high premium. For example, Honda Accord is quite a practical car, but it is also the most stolen car in the USA, hence, the premium is high.

Marital Status

For some, this might sound weird, but your marital status does affect your car insurance premium. Married people are generally considered to be more responsible, and least likely to be reckless drivers. Moreover, a 2004 study made in collaboration with DMV showed that married people have a 50% less chance of being in an accident when compared to singles. The most noticeable drop in insurance rates can be seen for men when they get married. Also, those with a clean record of driving for several years without any accident will see a considerable drop in their insurance rates once they get married.

Owning A House

Good news for homeowners! Owning a house affects your car insurance just like a good credit score. The thing is, people who own houses are considered to have less financial woes compared to those who stay in rented apartments or houses. Basically, car insurance companies trust homeowners more. Hence, their insurance rates are slashed.

Full-Time Jobs

A full-time job is another factor that might lessen your premium. Someone with a full-time job can see as much as a $30 discount on their premiums. Those who are in the military service or are veterans can expect about $50 less than civilians. So, those who are unemployed, start looking for a full-time job in case you want to get a lesser premium.

Your Driving Route

When you use your vehicle for commuting to work, you should expect a higher premium rate. The distance between your workplace and your house might also affect your premium rate as it increases the chance of an accident. In case you change your house and get closer to your workplace, you must inform your insurance provider, and see how your premium drops. Safe driving habits will also help you get a lower premium. Avoiding late nights, and driving in high traffic routes can increase your premium rate.

Finally, if you want the best deal for your insurance rate, then you must shop around and do your research. Different insurance providers will have different rates. Look around for the best rate and coverage, and you will have a great deal for sure.

More in Financial Advice

-

`

The Sky’s the Limit: Qantas Aims for Ultra-Long-Haul Records

Long-haul flights are making a grand return, signaling the optimism among airlines that international travel is on the rebound post the...

December 2, 2023 -

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023

You must be logged in to post a comment Login