4 Tools To Help You Manage and Budget Your Money Properly

One of the most important skills we need to learn in life the ability to budget and manage our money properly. Money, no matter how small or big it is, will always be not enough for us if we mishandled or mismanage it. We often find ourselves wondering why did our money disappear in just a snap when we’ve worked hard for it for almost a month. Quite frustrating, isn’t it? You felt deprived. You felt like it the money you have right now is not enough to pay your bills while letting you indulge in your luxury and leisure. However, oftentimes it turned out that that was not the case.

Why? It’s because most of the time, the money we earned is enough for us to sustain our lives. It all just comes down to how we manage it to provide all our needs.

If you have some serious trouble in improving your budgeting skills, we recommend you to start checking out these 4 tools to help you manage and budget your money properly. And in no time, we assure you that you’ll become a master in budgeting your money!

1. YNAB (You Need a Budget)

Although this app is a paid one, but we really recommend you to purchase one because it’s really helpful for you in the long run. In fact, it’s the top pick for users who wanted to hone their budgeting skills seriously. YNAB uses a spreadsheet layout to let you create your monthly budget in just a few minutes.

Not only that but YNAB encourage you to make your budget based on last month’s income. In this way, you’ll really practice your skills in budgeting based on the income you earned. One of the mistakes we committed why we feel like our money is not enough is because we keep on upgrading our lifestyle the moment we earn more. What YNAB teaches you to do is to list down only the things you need. Enabling you to maintain a sustainable lifestyle without draining your budget.

Finally, YNAB also gives you reports and graphs to let you monitor where your money goes. In this, way you’ll see the current flow of every dollar you spend or save. Remember that every dollar you spend matters, so it’s better to spend them wisely!

2. Personal Capital

If you’re anxious whether your capital and investments are paying off, then we recommend this app for you. You can link your banking accounts, investment accounts, insurance accounts here and monitor their growth or decline depending on the status in the Stock Exchange.

It can even track your retirement plans! At the end of the year, you’ll be able to estimate how much money you’re making, and how much you’ll be getting the moment you choose to retire and start harvesting the fruits of your labor. Whether you want to just relax and have a happy life or you want to start a business, you’re now secured that you have the capital to invest.

3. Quicken

Quicken lets you manage all your finance. Unlike YNAB, Quicken lets you connect your account to financial banking institutions automatically. This means that every penny you have, you will be able to monitor it here. Banks, savings accounts, budget, investments, credits, even your bills!

The moment you start creating your budget within the app, you can automatically pay your bills so that you won’t be tempted to use the money elsewhere. It offers you a strict discipline to manage your money properly.

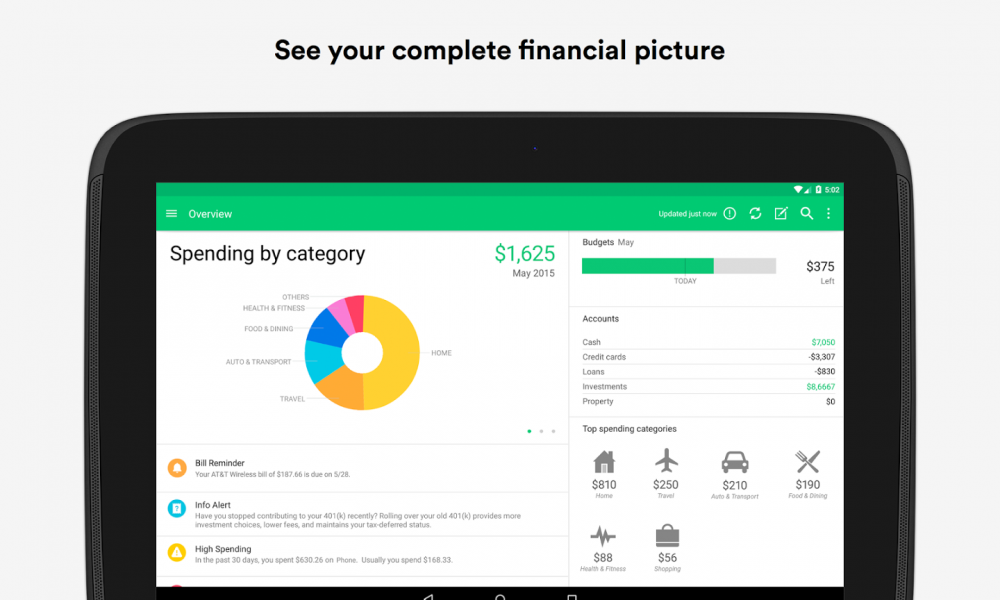

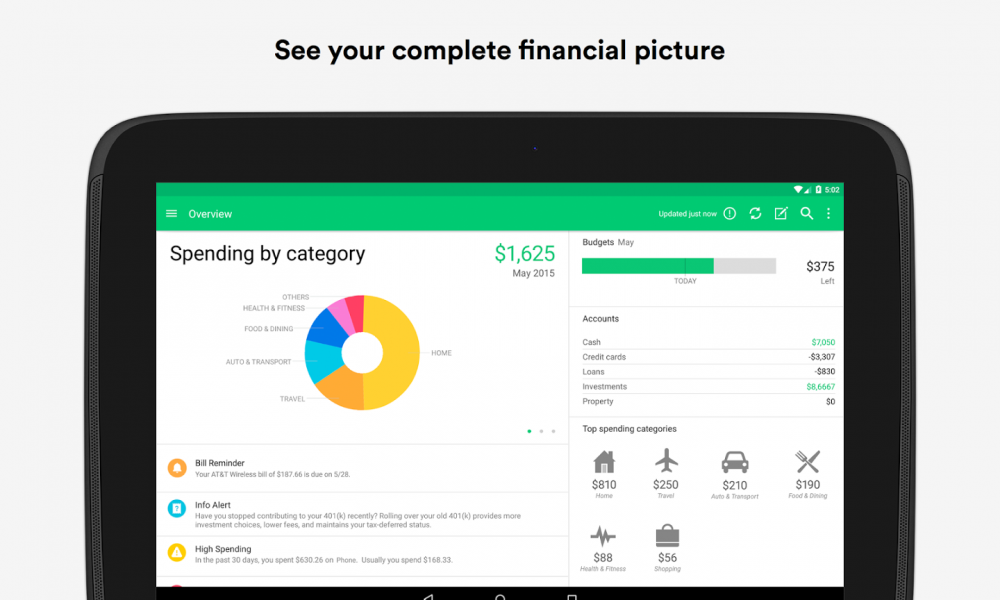

4. Mint

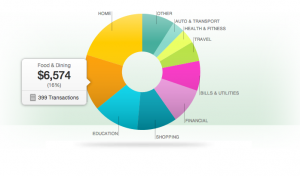

You could say that this is the sister app of Quicken since it’s also developed by the same company. What’s make Mint stand out from the first is its ability to not only track your finances, but also your income, assets, liabilities, and net worth as well. It offers a comprehensive view and graphs of your spending, budgets, and trends.

Since this app is also ad revenue, you can have this opportunity to see brokerage accounts and investments accounts. If you plan to have a business later, you’ll have at least some heads upon which financial institutions are best to invest your money when you retire.

More in Business & Investments

-

`

The Sky’s the Limit: Qantas Aims for Ultra-Long-Haul Records

Long-haul flights are making a grand return, signaling the optimism among airlines that international travel is on the rebound post the...

December 2, 2023 -

`

WWE SmackDown to Make a Comeback on USA Network in 2024

In a surprising twist, WWE’s Friday night staple, “SmackDown,” is bidding farewell to Fox and heading back to its old stomping...

November 24, 2023 -

`

Why Women Face Higher Out-of-Pocket Health Expenses

In healthcare, disparities persist, and a recent report from Deloitte underscores a significant financial gap between working women and men in...

November 18, 2023 -

`

Elon Musk vs Bill Gates: The Clash of Titans

In the realm of the world’s wealthiest individuals, a simmering rivalry has been captivating public attention. It’s not a clash of...

November 7, 2023 -

`

The Power Of Disconnecting

In our digitally driven age, where smartphones, tablets, and laptops have become extensions of ourselves, disconnecting might seem daunting. However, the...

October 31, 2023 -

`

JCPenney’s Bankruptcy: The End of an Era

JCPenney filed for bankruptcy in a move echoing the struggles of many retailers in the wake of the COVID-19 pandemic. This...

October 26, 2023 -

`

Reasons Why You Need a Financial Plan

Financial planning is not just for the wealthy or those nearing retirement. It’s a crucial tool for anyone seeking financial security...

October 19, 2023 -

`

How Brad Pitt Spends His Millions All Over the World

Brad Pitt, the charismatic Hollywood superstar, has left an indelible mark on the silver screen and made an impact in the...

October 10, 2023 -

`

Gen Z’s Posh Palate: The Unexpected Rise of Caviar Culture

Amid the backdrop of a digital era buzzing with viral dances, e-sports, and niche memes, there emerges a peculiar plot twist:...

October 7, 2023

You must be logged in to post a comment Login